Inflation Design

The CLV chain adopts the same inflation design as Polkadot's, as it's a proven and long-term economical design that we think fulfills the future development of the CLV ecosystem.

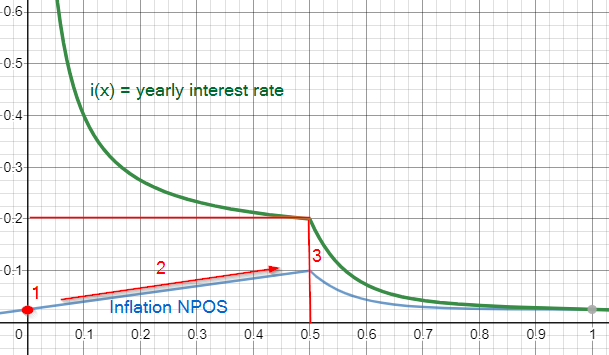

Inflation to validators is dynamic, between 2.25% - 20% annually, depending on $CLV staking rate on CLV Mainnet.

Although the total number of $CLV in circulation is the combination of the number of tokens on 4 chains ($CLV on Ethereum, BNB Chain, CLV Parachain and CLV Mainnet), the inflation model is only subject to the amount of $CLV circulating on the CLV Mainnet.

0%

2.25%

>125%

>1,500%

5%

3.25%

5.42%

65%

10%

4%

3.33%

40%

20%

5.5%

2.29%

27.5%

25%

6.25%

2.08%

25%

30%

7%

1.94%

23.3%

40%

8.5%

1.78%

21.3%

50%

10%

1.67%

20%

60%

4.38%

0.61%

7.3%

70%

2.97%

0.35%

4.2%

80%

2.62%

0.28%

3.3%

90%

2.53%

0.23%

2.8%

100%

2.51%

0.21%

2.51%

Inflation & Staking Rate Formula

The value of the staking rate should lie between 30% and 60% - ideally at 50%. If it falls, the security is compromised, so we should give strong incentives to $CLV holders to stake more of their assets. If it rises, we lose liquidity, so we should decrease the incentives sharply.

x = staking rate(x is always a value between 0 and 1)

green graph = i (x) yearly interest rate

blue graph = I (x) inflation rate to stakers

x-axis represents the total staking rate, y-axis interest rate (green) or inflation to validator rate (blue)

Number 1 displayed in the graph is the minimum of the inflation to stakers (i.e. when neither validators nor nominators are staking $CLV). It’s the inflation “starting” point; 0.025 → 2.5% in this case goes away for validator rewards.

The second number shows a linear increase of inflation if the staking rate is between 0 and 50%. There is a linear correlation between the staking rate and inflation till 0.5 is reached. The inflation rate is 5% if the staking rate is at 25%. If the staking rate doubles to 50%, so does the inflation rate to 10%. But remember: It is only linear till 50% staking rate is reached.

The red line at number 3 is the ideal staking rate of 50%. In this case, the annual staking reward is at 20%. But if the staking rates exceeds 50%, there is an exponential decay in inflation, which results in a strong decay of staking rewards. The reason for that is that the network needs liquidity and decreases the incentives sharply if the staking rate exceeds 50%.

For Further Reference (Polkadot inflation design 2021):

Polkadot’s Tokenomics and Interoperability - Coinbase Research

Polkadot Inflation and Staking Reward Analysis - Swiss Staking

Economics of Polkadot - Polkadot Blockchain Academy

Web3 Foundation’s Overview of Polkadot’s Token Economics - Web3 Foundation

Last updated